Verizon Shareholders to Vote for Change of Course as Investor and Customer Concerns Grow

Days before Verizon’s annual shareholder meeting, the Communications Workers of America (CWA) announced today that Verizon workers, who also hold an estimated $1.3 billion in the company’s stock, will vote for a series of shareholder proposals to improve the company’s corporate governance. Verizon workers, who have been on strike since April 13, are saying the company’s short-sighted decision-making is hurting Verizon’s shareholders, customers and long-term viability.

CWA and IBEW members recently shared their shareholder proposals recommendations with Verizon shareholders across the country who together own more than 60 percent of Verizon’s total shares. The strike has prompted significant concerns among major investors, including New York State Comptroller Thomas DiNapoli, who leads public pension funds that include $593 million in Verizon stock. In a recent letter to Verizon CEO Lowell McAdams, DiNapoli said: “A protracted strike of this magnitude would undoubtedly affect the morale and productivity of Verizon employees. I am concerned that a disenfranchised workforce and the associated negative publicity may ultimately impact Verizon’s profitability.”

The growing calls for change of course at Verizon come as public opinion of the company has declined to a three-year low, according to a recent survey from YouGov. Top economists and financial analysts have been raising concerns about the company’s short-sighted business decisions and the long-term impact of the strike. Several investment firms have recently lowered their Verizon ratings, including Jeffries, Scotiabank, Sanford Bernstein and Zacks.

“All Verizon shareholders should be alarmed at the corporation’s penny wise but pound foolish business strategy,” said Mark Balsamo, a recent Verizon retiree who lives in Baltimore, Md. “Verizon executives have consistently put short-term profits over the long term sustainability of the company, including the basic needs of its workforce. Instead of investing in good jobs and expanding service for consumers, Verizon is refusing to negotiate with workers in good faith and failing to keep its promises to meet consumer demand for its FIOS service. As Verizon employees, we want our customers to get the quality they deserve. As shareholders ourselves, we know it’s time to make some major changes to ensure that Verizon’s corporate leadership is accountable to all of us.”

Verizon Workers, Major Shareholders Call for Change

Verizon workers are concerned with current executive decision-making, including the impact of the strike forced by management, regulatory investigations into Verizon’s infrastructure, broken promises to expand FiOS to communities and excessive executive compensation.

Verizon workers, with an estimated $1.3 billion in stock holdings, will vote in favor of a series of shareholder resolutions at the company’s annual general meeting, including:

- Proposal #7, Kenneth Steiner requests to amend company’s governing documents to require that the Board Chair be an independent director. Supporters include: CalPERS and CalSTRS

- Proposal #8, the Association of BellTell Retirees seeks shareholder approval of future severance agreements (also known as golden parachutes) that grant executives benefits exceeding 2.99 times their base salary plus bonus. If he was terminated in 2015, CEO Lowell McAdam would have received $40.2 million under the current policy. Supporters include: Institutional Shareholder Services, CalPERS and CalSTRS

- Proposal #9, the International Brotherhood of Electric Workers Pension Benefit Fund requests that the Human Resources Committee require executives to retain 75% of the shares they receive has part of their compensation packages. Supporters include: CalPERS

Investor, Customers Concerns Grow

Over the past three years, Verizon has made $39 billion in net income, averaging $1.5 billion a month for the last 15 months. The company’s CEO was paid $18 million last year – 243 times more than the average Verizon worker. The company has continued to push outsourcing and offshoring plans that would devastate workers’ families and leave the company without enough workers to properly maintain the Verizon network. A recent Star-Ledger editorial blasted Verizon’s refusal to negotiate a fair contract, noting that the “tech titan built on recognizing consumer behavior can’t grasp the basic needs of its own workforce.”

Verizon’s short-sighted business practices have faced sharp public criticism from top economists and analysts. Roosevelt Institute fellow Mike Konczal noted that last year’s $5 billion Verizon stock buyback could have translated to $28,000 per worker, or been used to install FIOS in 10 million additional households. In the New York Times, Paul Krugman accused Verizon of treating its broadband business as a “cash cow” without spending money on improving or even maintaining existing service.

The deterioration in service has become so significant that New York State’s Public Service Commission has convened a formal hearing to investigate problems across the Empire State. In the last few weeks, regulators in Pennsylvania and New Jersey have launched similar inquiries into Verizon’s operations.

Verizon customers are growing increasingly frustrated with the company, with more than 300,000 people signing petitions in support of striking workers.

From the Desk of the Vice President of CWA District 1

“The hard work is just starting, but nurses are good at hard work”: Cayuga Medical Center Nurses Vote to Join CWA!

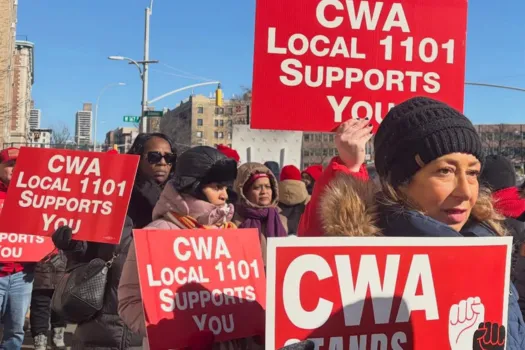

Largest Nurses Strike in NYC History: CWA Stands with NYSNA!